What Does Personal Loans Canada Mean?

What Does Personal Loans Canada Mean?

Blog Article

The Greatest Guide To Personal Loans Canada

Table of ContentsNot known Details About Personal Loans Canada The Of Personal Loans CanadaThe 6-Second Trick For Personal Loans CanadaOur Personal Loans Canada IdeasUnknown Facts About Personal Loans Canada

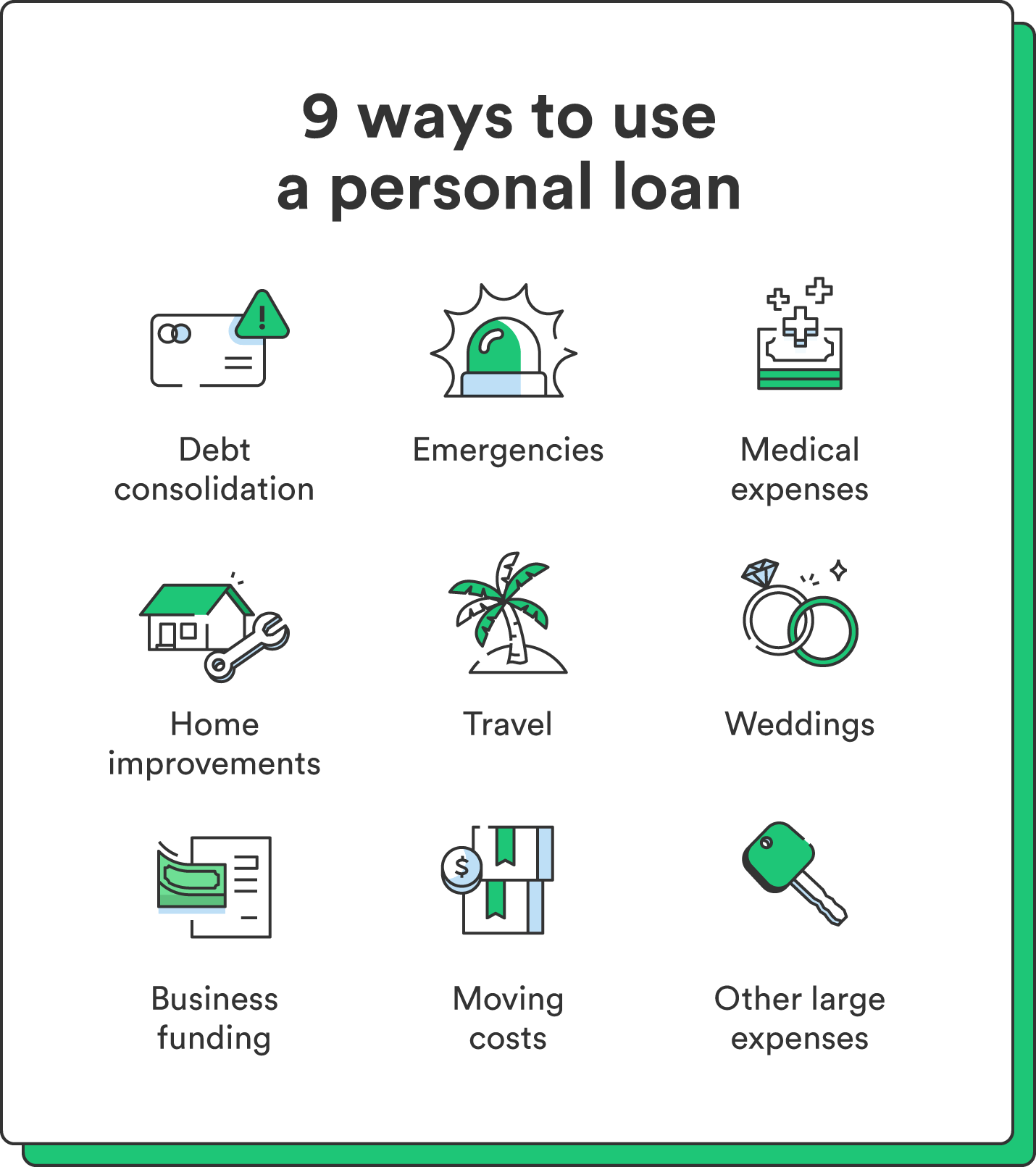

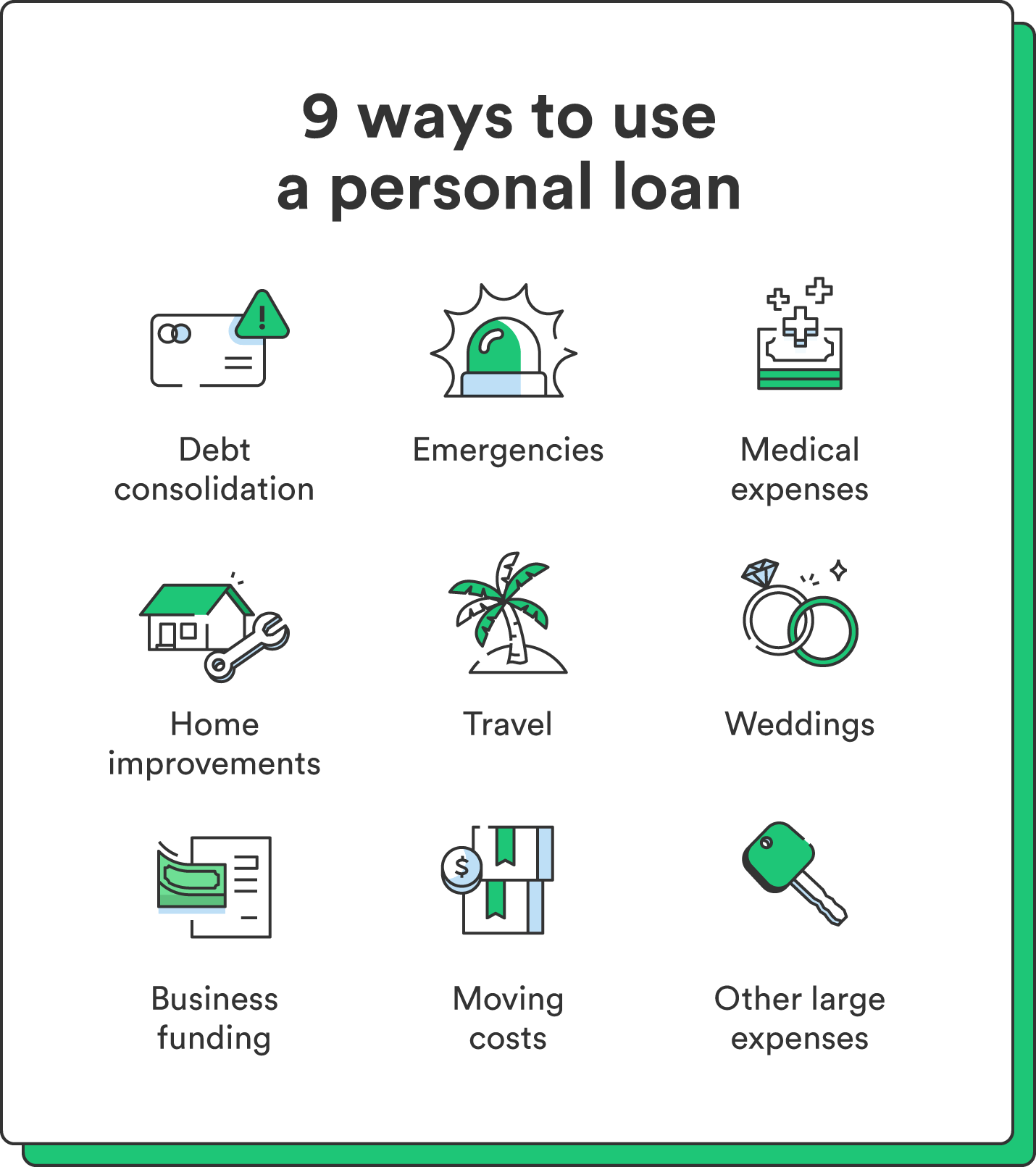

Let's dive right into what an individual funding actually is (and what it's not), the factors individuals utilize them, and exactly how you can cover those insane emergency expenditures without tackling the worry of financial debt. A personal financing is a swelling sum of cash you can obtain for. well, nearly anything.That does not include obtaining $1,000 from your Uncle John to help you spend for Christmas offers or allowing your flatmate place you for a pair months' rent. You should not do either of those things (for a number of factors), but that's technically not an individual car loan. Personal finances are made with a real economic institutionlike a bank, cooperative credit union or online loan provider.

Allow's take a look at each so you can know exactly just how they workand why you do not need one. Ever before.

Everything about Personal Loans Canada

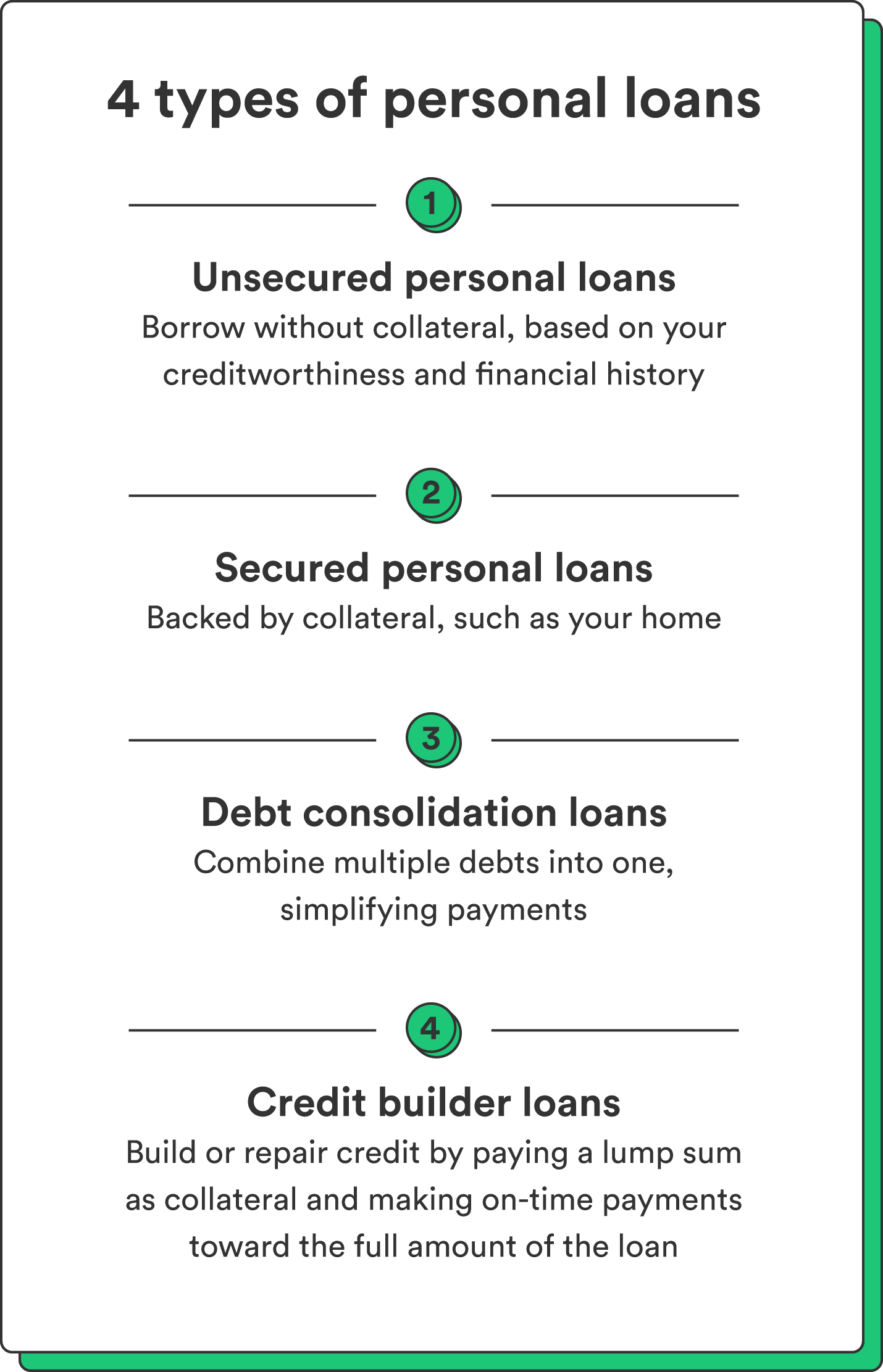

Surprised? That's okay. Regardless of exactly how excellent your debt is, you'll still have to pay rate of interest on a lot of personal finances. There's always a price to spend for obtaining money. Guaranteed personal loans, on the various other hand, have some kind of collateral to "secure" the lending, like a boat, fashion jewelry or RVjust among others.

You can likewise get a safeguarded individual lending utilizing your vehicle as collateral. But that's an unsafe step! You don't desire your primary mode of transport to and from job getting repo'ed because you're still paying for in 2014's kitchen area remodel. Depend on us, there's absolutely nothing secure regarding secured lendings.

Simply due to the fact that the payments are predictable, it does not mean this is a great offer. Personal Loans Canada. Like we claimed in the past, you're virtually guaranteed to pay rate of interest on an individual car loan. Simply do the mathematics: You'll end up paying way much more in the lengthy run by getting a financing than if you would certainly simply paid with cash

All about Personal Loans Canada

And over here you're the fish holding on a line. An installation finance is an individual financing you repay in fixed installments with time (typically once a month) until it's paid completely - Personal Loans Canada. And do not miss this: You have to pay back the original car loan amount prior to you can obtain anything else

Don't be misinterpreted: This isn't the exact same as a debt card. With individual lines of credit score, you're paying rate of interest on the loaneven if you pay on time.

This one obtains us riled up. Due to the fact that these services prey on individuals who can not pay their bills. Technically, these are short-term car loans that give you your income in advance.

Top Guidelines Of Personal Loans Canada

Since points obtain actual unpleasant actual quick when you miss a payment. Those creditors will come after your sweet grandmother who cosigned the lending for you. Oh, and you ought to never cosign a car loan for any individual else either!

All you're actually doing is utilizing new debt to pay off old financial debt (and prolonging your funding term). That simply means you'll be paying much more gradually. Companies know that toowhich is specifically why so numerous of them provide you debt consolidation lendings. A lower rate of interest does not obtain you out of debtyou do.

And it begins with not borrowing any kind of more cash. Whether you're believing of taking out visit this site right here an individual finance to cover that kitchen remodel or your frustrating credit scores card bills. Taking out financial debt to pay for things isn't the method to go.

Facts About Personal Loans Canada Revealed

The very best point you can do for your economic future is get out of that buy-now-pay-later mindset and say no to those spending impulses. And if you're thinking about an individual funding to cover an emergency situation, we get it. But borrowing money to pay for see page an emergency only intensifies the stress and anxiety and challenge of the circumstance.

Report this page